(I do not know if these panels will be publicly available after the end of the conference.)

Recent Posts

Wednesday, May 31, 2023

CEA MMT Panel Post-Mortem

Monday, May 29, 2023

U.S. Breakeven Inflation Comments

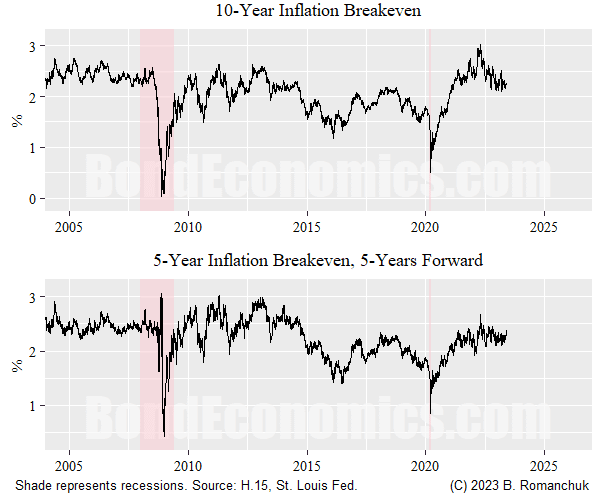

Background note: the breakeven inflation rate is the inflation rate that results in an inflation-linked bond — TIPS in the U.S. market — having the same total return as a conventional bond. If we assume that there are no risk premia, then it can be interpreted as “what the market is pricing in for inflation.” I have a free online primer here, as well as a book on the subject.

(As an aside, I often run into people who argue that “breakeven inflation has nothing to do with inflation/inflation forecasts.” I discuss this topic in greater depth in my book, but the premise that inflation breakevens have nothing to do with inflation only makes sense from a very short term trading perspective — long-term valuation is based on the breakeven rate versus realised inflation.)

The top panel shows the 10-year breakeven inflation rate. Although it scooted upwards after the pandemic, it is below where is was pre-Financial Crisis, and roughly in line with the immediate post-crisis period. (Breakevens fell at the end of the 2010s due to persistent misses of the inflation target to the downside.) Despite all the barrels of virtual ink being dumped on the topic of inflation, there is pretty much no inflation risk premium in pricing.

The bottom panel shows forward breakeven inflation: the 5-year rate starting 5 years in the future. (The 10-year breakeven inflation rate is (roughly) the average of the 5-year spot rate — not shown — and that forward rate.) It is actually lower than its “usual” level pre-2014, and did not really budge after recovering from its post-recession dip. (My uninformed guess is that the forward rate was depressed because inflation bulls bid up the front breakevens — because they were the most affected by an inflation shock — while inflation bears would have focussed more on long-dated breakevens, with the forward being mechanically depressed as a result.)

Since I am not offering investment advice, all I can observe is the following.

Since it looks like one would need a magnifying glass to find an inflation risk premium, TIPS do seem like a “non-expensive” inflation hedge. (I use “non-expensive” since they do not look cheap.) Might be less painful than short duration positions (if one were inclined to do that).

Breakeven volatility is way more boring than I would have expected based on the recent movements in inflation. The undershoot during the recession was not too surprising given negative oil prices and expectations of another lost decade, but the response to the inflation spike was restrained.

The “message for the economy” is that market pricing suggests that either inflation reverts on its own, or the Fed is expected to break something bigger than a few hapless regional banks if inflation does not in fact revert.

Otherwise, I am preparing for a video panel on MMT at the Canadian Economics Association 2023 Conference on Tuesday. (One needs to pay the conference fee to see the panel.) I have also been puttering around with my inflation book. I have a couple draft sections that I might put up in the coming days/weeks.

Thursday, May 25, 2023

Degrowth Versus Sustainability

Tuesday, May 23, 2023

Pleading The Fifth On The Fourteenth

(I hope to deliver that other article tomorrow.)

Friday, May 19, 2023

On Steve Keen & Friends Livestream

I will be on the Steve Keen & Friend Livestream tomorrow (May 20) at 12 noon Eastern Standard Time. (Link to the stream above.) There is no set topic, but I guess there will be a discussion of the state of macro theory.

Wednesday, May 17, 2023

When Will The Russian Invasion Of Ukraine End?

I see a lot of commentary on the war in Ukraine that is fundamentally misguided. As usual, I do not have a forecast answer to the question in the title of this article, rather I want to discuss how to think about it.

I am not a military analyst, but I am not writing anything that is particularly deep. I am just explaining the basics of post-World War I military doctrine that are not understood in pop culture. Readers only interested in economic commentary probably want to skip this.

Monday, May 15, 2023

Money Multiplier Mudslinging

https://twitter.com/IrvingSwisher/status/1657812041812303876?s=20

There was a small kerfuffle on Twitter created by Olivier Blanchard regarding the money multiplier in the next version of his textbook.

Skanda Amarnath gave a reaction which matches my view, but I just want to add a couple of extra comments.

Tuesday, May 9, 2023

"Greedflation" Debate

I have started writing a section for my book on the “greedflation” debate: are corporations jacking up prices to pad profit margins? Since I wanted my book to mainly focus on basic facts about inflation that are true, and not unresolved theoretical debates, it is not entirely a great fit. I was planning on publishing my draft today, but I decided to hold back and explain why that is.

Friday, May 5, 2023

Will The Fed Keep Reacting With A Lag To Lagging Data?

(I have broken Betteridge’s law of headlines — the answer to the question in the headline is “yes.”)

I would guess that this week’s Fed hike will be followed by a “pause,” but that pause may be just for one meeting. Although my bias is to assume that the weakness is partly equity market shenanigans, the banking system is having trouble digesting rate hikes. The Fed can afford to wait a meeting to see what happens.

Monday, May 1, 2023

Another Bank Bites The Dust

First Republic Bank was forced into a take over by J.P. Morgan Chase, and was yet another Californian victim of bad banking risk management. My bias was that First Republic was not large enough to worry about, so I cannot offer any insights into the event. My main complaint is that this appears to be another bank that blew itself up with interest rate risk, which makes my life of writing a banking primer more difficult. I had always made allowances for bad bank risk management in the United States, but I had underestimated how large an incompetent bank can get.

Other than for the unfortunate owners of securities issued by First Republic (and apparently wealthy people in San Francisco who wanted overly generous mortgages), the demise of this bank is not a big deal by itself for the macroeconomy. Instead, the issue is whether there are still other weak links in the banking system? I am not in a position to have a strong opinion on that question, but it would be a question worth looking in to. My bias is to not pay too much attention to interest rate risk — credit risk is the killer for financial systems. Although I am seeing people pointing to commercial real estate risk, I do not think I could point to a time in recent decades where somebody was not worried about credit risks in commercial real estate.

The usual worry is that the Fed hikes until something breaks — which is exactly how I describe previous cycles.1 Since the current bank failures were due to interest rate risk, we can blame them on Fed action. The question is whether these are enough to derail the economy? Although the Monetarist-inclined are worried about M2, my concern is credit growth (since Fed balance sheet shenanigans are forcing reallocations of financial assets which do not have much economic impact). One measure of credit that I like — commercial & industrial (bank) loans outstanding (above) — has rolled over.

As can be seen in the chart, C&I loans rolling over only tended to happen in recessions. However, we did see a lack of growth in the mid-2010s without a recession (circled episode), so I would be cautious about panicking.

I am not in the forecasting business, and do not want to be calling for recessions every six months. Although there are certainly negative vibes, one can still argue that they are consistent with a “soft patch,” which is a part of lengthy modern business cycles. You pays your money, and you takes your chances.

There is a survivorship bias in that observation. It could be explained by (1) business cycles being typically ended by financial fiascos, and (2) the Fed tending to hike rates until the expansion ends, with (1) and (2) being independent.