I entered into a private conversation about techniques that academics use to isolate the alleged effect of fiscal deficits, quantitative easing, (etc.) on bond yields. I tend to be somewhat skeptical about such attempts, but there has been some work done that looked more reasonable. (I probably should highlight that research, but I would have to get back to it at a later time.) My argument is that if you want to any research in that area, you want to go after the 5-year rate, 5 years forward (or a qualitatively similar forward). If you can explain that rate, I would be interested.

This article is halfway between a rant and a serious discussion of the application of quantitative techniques. It is extremely difficult for it to not be a rant, since my argument is that the literature and the accepted methodology took a wrong turn a very long time ago. I will even have a bit of a rant about mainstream economists, which is probably the only bit that a lot of my readers are interested in.

Analytical Problem

The analytical objective is being able to predict government bond yields, and/or be able to see what factors influence them. In particular, many people are obsessed about factors that affect “supply and demand”: fiscal deficits, quantitative easing, foreign central bank purchases, etc.

Can we model these effects, so that we can legitimately make statements like “this year’s deficit raised the 10-year bond yield by 30 basis points.” (People do make statements like this all the time, the problem is that their analysis is almost invariably hogwash.)

There are two typical ways of judging the usefulness of a bond yield model: my way, and the wrong way.

The correct way of judging the usefulness of a bond yield model is asking whether it is possible to make money with it. If you can, the model offers some useful forward-looking information.

The wrong way of judging the usefulness of a bond yield model is whatever the accepted practice currently is in economics and econometrics journals. As far as I can tell, there’s a lot of fiddling with statistical tests. Although statistical tests sound scientific, in practice, the output of the process are models with zero predictive content. The fact that these models are in the public domain and not used by fixed income practitioners tells us all we need to know about their fair market value (bid of $0).

There is a fairly simple example of why “making money with the model” is the correct metric, and “statistical tests” is not. Every so often, one runs into someone with a physical sciences background that develops a bond yield model that has a much tighter prediction error than other methods. Wow, how amazing! Unfortunately, the reason is straightforward — they fed historical bond yields as an input to the model. Very simply, yesterday’s yield is normally a very good predictor of today’s.

Although this tells us about the level of bond yields, it gives us no way to make money. If we are looking at today’s yields versus yesterdays, we need to predict today’s yield change. Although day traders attempt to do exactly that, I would allocate 0% of my portfolio to day traders.

Conversely, if we had a “fair value model” that generated a predicted level that yields revert towards (the Holy Grail of fixed income analysis), then we can live with a large average daily prediction error, since we make money on the reversions. (Using the previous day’s yield as a “prediction” offers no information two days ahead, since we do not yet know the end of day yield until the close.)

Mainstream Economist Rant Incoming — 1, 2, 3…

If we look at the past history of mainstream bond yield modelling, one can safely summarise the literature: desperate attempts to get the “correct answer,” which is the Economics 101 supply and demand story. In particular, fiscal deficits “crowd out” the private sector by raising interest rates. This was the core plank of Rubinomics.

However, as I discuss in Section 6.2 of my report Understanding Government Finance, the reality is that the only reliable statistical relationship we can find shows the opposite result — the higher the debt-to-GDP ratio, the lower the nominal bond yield. As I discuss therein, there are very good reasons for this relationship, and the correlation is semi-spurious. The problem for our mainstream friends is that if reality starts off with the “wrong” sign for their theory, it takes a lot of data “massaging” to get the sign to flip. The literature is a sequence of increasingly complex ways of trying to get the sign to flip.

I will admit that I stopped looking at that literature some time ago, and I suspect that there might have been improvements. Some of the more observant mainstream economists noticed the hundreds of MMT fans dunking on them for horribly incorrect takes in online forums, and my feeling is that there has been at least some movement towards being reality-based in recent years by at least some members of the mainstream. This may have seeped into the literature in this area.

Having dunked on failed approaches, I will now outline what I would see as being the right starting point.

What is the 5-year/5-year?

My argument is that you want to explain the following two rates:

the spot 5-year rate, and

the 5-year rate, 5 years forward.

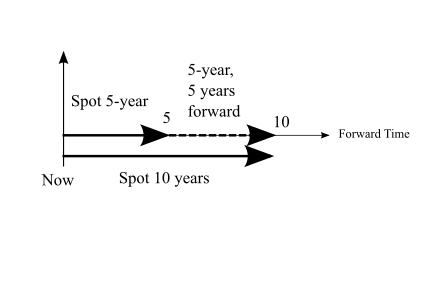

The above might appear to be fixed income jargon, but it is not too hard to see what they are. Right now, we can call up our friendly local fixed income salesperson, and get quotes on 3 instruments (if we are happy with swaps, and have an ISDA set up): the 5-year spot rate, the 10-year spot rate, and the 5-year rate, starting 5 years forward.

As the diagram above shows, if we enter into a 5-year rate position, we have an investment that covers the time period from “now” to 5 years in the future. The forward rate covers the period from 5 years in the future to 10 years in the future. This matches the time period covered by the 10-year rate.

(A 5-year, 5-year forward can be easily traded as a swap, but much less easily as a Treasury. However, we can back out a theoretical Treasury forward from data provided by a fitted curve.)

If we use the word “average” loosely, we can see the following.

The 5-year rate is the “average” of instantaneous forward rates over the time frame of 0- to 5-years forward.

The 5-year/5-year rate is the “average” of the instantaneous forward rates over the time interval of 5- to 10-years forward.

The 10-year spot rate is the “average” over the interval of 0- to 10-years forward.

So if we are again loose with our definition of “average,” the 10-year spot rate is the average of the 5-year rate, and the 5-year/5-year forward. (We could decompose the 10 year into other combinations, where average is weighted by the maturity of the two tenors in the decomposition.)

So what we want to do is explain the 10-year spot rate by trying to explain the 5-year spot rate and the 5-year/5-year forward (somewhat) independently.

Why the 10-year?

Why do we want to explain the 10-year yield? The reason is based on market structure: the 10-year benchmark is an important benchmark. If we look at the duration of private and public sector issuance, it is heavily weighted towards the front end, and then tails off drastically after the equivalent of the 10-year point.

(In the United States, one might immediately note conventional 30-year mortgages, which are a huge market. However, those mortgages are amortising, so the duration is much closer to a 10-year Treasury than a 30-year Treasury. Working from memory, some parts of continental Europe might offer more duration from residential mortgages.)

Given the general disdain modern management has for their credit rating, lending for more than 10 years to anything other than regulated utilities (or similar) is a recipe for disaster. The only credit report I can recall writing documented the travails of the European telecom industry. Up until the early 1990s, the incumbent telecoms were public utilities with AAA credit ratings. Then those darned neoliberals privatised them, and the utilities went nuts bidding on 3G wireless licenses, as well as building out 3G and internet infrastructure. The incumbents were clinging desperately to the bottom tier of investment grade just within about five years of being AAA-rated.

This means that if you can explain the front end out to the 10-year, you have covered most of the fixed income market cap. The long end (e.g., 30-years) have a lot of duration and excitement. However, they are more equity-like in their unpredictability, and I am not a fan of unpredictability.

First Five Years: Expectations Matter!

Any fixed income instruments with a final maturity of five years or less have a pricing driven by rate expectations. Where is the overnight rate now, and where is it going?

Any amount of time looking at modelling the 5-year Treasury will tell you that one’s uncertainty about “what are expectations, anyway?” will dwarf any other factor that could conceivably affect valuations. Unless central bankers suddenly change their reaction functions, the expected path of the overnight rate will follow the business cycle.

I am not saying that getting the level of the 5-year yield is easy, but I do not see much value in pretending that we can get much further than trying to model “expectations.”

The 5-Year/5-Year: Effect of Cycle And Long End Muted

We then turn to the 5-year/5-year. It starts far enough in the future that we can argue that it is beyond most plausible economic forecasts. Instead, all we can really do is hope that the economy reverts to some sort of “steady state,” and so we should expect that the yield represents some form of steady state value.

If we then want to believe that debt levels (or whatever) matter for rates, this is where they should show up.

Meanwhile, by cutting off the final maturity of the forward at 10 years, we are still within the liquid part of the yield curve. In addition to government supply, that is where private supply comes. This keeps us away from the 30-year part of the curve, which can be extremely sensitive to supply and demand (although not the supply and demand that economists look at, as I discuss below).

Based on the conversation I had, it looks like economists are gravitating towards the 10-year rate, 5-years forward. Although looks somewhat sensible, I would prefer to stick to the 5-year/5-year. The 15 year point of the curve is not liquid, and I would price it via a 10-/15-/30-year butterfly — which drags in the 30-year.

Explaining the Forward Not Trivial

Coming up with a model for the 5-year/5-year is not going to be easy — if it were, you could go run off and set up a fixed income hedge fund and print money. That will not stop academics from trying. I will just offer a few observations.

If we accept the argument that the 5-year/5-year ought to revert to some steady state value, the simplest plausible model is that the steady state reversion value would be some form of historical average of either the forward rate, or the realised spot rate (plus a term premium). From what I have seen of fixed income fair value models, I suspect that a lot of them would underperform that specification.

The next thing thing to note is that if a factor affects the forward rate, unless it also affects the spot 5-year rate, the effect on the 10-year spot rate is half of that of the forward. Since most people quote the effect on spot rates, the effect on the forward would be double (or less than double if some of the effect bleeds into the 5-year).

We can then ask how plausible some of the “rate effects” that economists throw around. For example, current U.S. fiscal policy is often alleged to have raised bond yields — but why would we expect forward rates to be trading below historically realised rates? (I know, QE.) If we tried translating some alleged coefficients from the U.S. to Japan, the fair value for JGB’s would have been comically low for a long time.

Finally, we need to question how significant an effect is its alleged impact is less than the trading range for a month. Any effect less than 50 basis points on the 10-year spot rate is indistinguishable from trading noise.

30-Year Supply and Demand: Demand Matters!

Once we are discussing the 30-year point of the curve, supply and demand do matter more. The reason is the inability of the private sector to credibly offer 30-year tenors (which also limits inflation-linked supply). Meanwhile, regulators force insurance and pension funds into 30-year bonds.

“Supply and demand” only matter for pricing if investors are price insensitive — they do not care about expected returns. (If they are price sensitive, they should price everything as efficiently as possible.) If regulators are forcing you to buy 30-years, you are by definition price insensitive. What happens when there is not sufficient float to absorb these buyers? You get the U.K. gilt curve of the 1990s, that is what you get.

If want to model “supply and demand,” we need to get a handle on all the factors that matter. That is not just what is easy to measure or fits ideological predilections (which describes the usual situation), we need everything. We also need summary measures. The current research strategy is to add individual factors as they pop up, like foreign central bank purchases, or quantitative easing. By adding “new” factors that spike in each cycle, economists are effectively adding a dummy variable each cycle — which makes it rather easy to keep a model output near observed data. If we had a single “supply” variable, we then no longer have a half dozen dummy variables to monkey around with.

Obliterating Pricing With QE

I will conclude with an extension of my discussion of ultra-longs: what happens if the central bank goes nuts with quantitative easing?

If the central bank can take down all the free-floating duration in some part of the maturity curve, they are in a position to dictate pricing. They do not need to buy everything; there are other price-insensitive bond buyers. However, they need to overcome the private sector supply of duration as well.

If we look at the U.S. dollar market in the last cycle, I am in the camp that QE was too small to achieve that level of dominance. They bought a big slug of Treasurys and MBS, but there was enough duration (including the Treasury extending the duration of issuance) that we ended up in the position that most of the researchers who claimed QE worked were researchers at the Fed itself.

However, if we look at other episodes, central banks did manage to assert dominance. Not every country has the hyper-active borrowers of the U.S. dollar rates complex has.

This is somewhat unpleasant from a modelling perspective. We cannot just plug in “QE” as some kind of linear factor: purchases may have a negligible effect until some threshold is hit, at which point yields are whatever the central bank wants them to be. Since the central banks did not announce price targets, there’s not a whole lot to work with.

Concluding Remarks

The literature attempting to link bond yields to things like deficits is large and varied. Rather than attempt to discuss each paper as it comes, I would instead suggest looking at the basic underlying principles involved, and focus on papers that are not making obvious errors.

Even if the reader is more charitable to this research than myself, my suggestion is to not blindly follow researchers to where they want to go, you want to instead apply whatever methodology they are using to a more useful problem statement. My suggested decomposition into the 5-year spot and the 5-year/5-year forward is probably going to frame the research in a much cleaner way.

Email subscription: Go to https://bondeconomics.substack.com/

What do yo make of this Brian ?

ReplyDeletehttps://seekingalpha.com/article/4445219-the-smart-money-is-betting-on-a-market-meltdown

You must have heard this a million times over the years.

Can you point me to a post on your blog that discusses these arguements in more detail !

Thanks.

I didn’t see a notification for this comment, hence the slow reply.

DeleteThere’s some tangents in there I don’t buy. But will inflation roll over? Most likely. Will the Fed hike soon? Probably not. The problem for the bond market is that it’s pricing years of unchanged Fed policy, which seems somewhat risky.

This comment has been removed by a blog administrator.

ReplyDelete