The July CPI report for Canada, and as expected, the annual rate of inflation remains high courtesy of comparisons to lockdown pricing in 2020. I am largely on the side of “Team Transitory”: the punchy annual inflation rates will subside once we are past weak comparisons, and some of the supply disruptions are cleared.

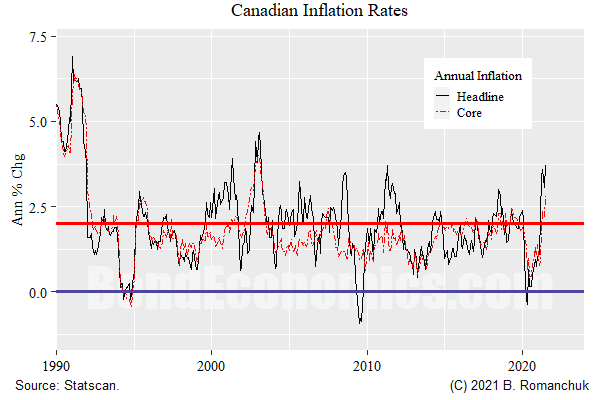

The chart above shows the annual inflation rates for all items (“headline”) and ex-food and energy (“core”) CPI. Although the latest surge looks impressive, we should not that we had a few such jump in the inflation targeting era (after 1992). So this is not exactly uncharted territory.

However, my conviction about the transitory-ness is somewhat soggy.

From a global perspective, disruptions to supply chains are not disappearing quickly. Shipping is in turmoil, and the crypto industry is snarfing up semiconductors, and I am unsure when that will clear. (This is nature’s revenge on the younger generation of electrical engineers who had the insane desire to stick advanced digital electronics in practically everything. Folks, toaster technology largely peaked without even needing a vacuum tube, never mind a transistor.)

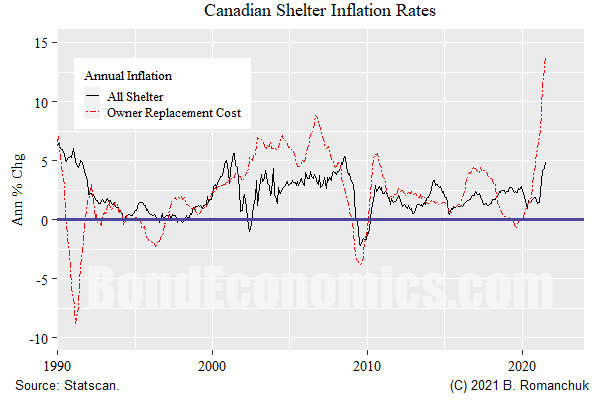

From the Canadian perspective, the shelter component of the CPI is quite energetic. The black solid line in the chart above shows the annual inflation rate of the shelter component of the CPI — which has a weight of 30.03% of the entire basket. It is in the neighbourhood of 5% — which is roughly where it peaked in the 1990s and 2000s cycles.

The standout performer is the red dashed line — homeowner’s replacement cost. This component of the CPI (5.61% of the total basket) is how house prices work their way into the CPI. It is based on the price index for new homes (but not existing).

Although it seems likely that the homeowner replacement cost inflation will tone down, it is less obvious why shelter cost inflation will drop back to 2%. Given the weight of shelter, it might be difficult to keep inflation near target.

Canada’s current situation is the result of relying on mainstream economic theory. The inflation target was given the highest priority, with thinking about inflation reliant on aggregates and unmeasurable variables like the output gap. Meanwhile, the demonisation of fiscal policy and the elevation of monetary policy meant that rate cuts were the hammer in a world full of nails.

If we stripped away the mainstream framing, Canada’s macro policy was simple: pump huge amounts of air into an already bubbly housing sector via rate cuts to boost aggregate demand. However, supply constraints meant that the animal spirits in real estate drove costs to the moon. The existence of laid of food service employees is not going to do much to suppress lumber prices on any reasonable time frame.

At this point, I do not see any easy way out. Rate hikes would likely cool enthusiasm for real estate expenditures, but the question is how to avoid something going horribly wrong. Raising rates ahead of the United States creates the possibility of speculative inflows to Canadian dollar assets, cutting into exporters’ competitiveness. Like last cycle, everyone has to hope that the Canadian economy will somehow rebalance away from sell each other houses at ever-rising prices.

Seems odd to saddle the least-wealthy with the regressive "inflation tax" to avoid cooling the real estate sector. Sad, really.

ReplyDelete